Lippo Mall REIT giving 6.7% yield. Buy or Bye?

My criteria to REIT selection:

-

Dividend yield > 6%

This is main reason why we invest in REIT. When doing my homework, I don’t expect the price of the shares to go up. I am more concern about the under lying assets that the REIT holds.

-

Price to NAV < 0.7

The primary value of a REIT comes from the market value of the properties owned, the NAV, which is equivalent to its assets less liabilities, of a REIT would give an indication of its value.

So to by comparing it with current stock price, it will indicate if there is a discount on the under lying asset. The discount will give you some upside opportunities.

-

Debt to Asset < 0.35

We all learned from the last crisis that if you expand too fast too much, you will end up in hot soup.

-

Quality of its Properties

This is the most important factor. If the property is good and have growth potential, banks will be more willing to provide loans.

-

Financial strength of its main Shareholders

Not a lot of investors take this into consideration. But I view this just as essential as when a crisis come, the parent company can easily support it.

With the above factors in mind, let’s use Lippo Mall Trust as a study case.

-

Dividend Yield >6%

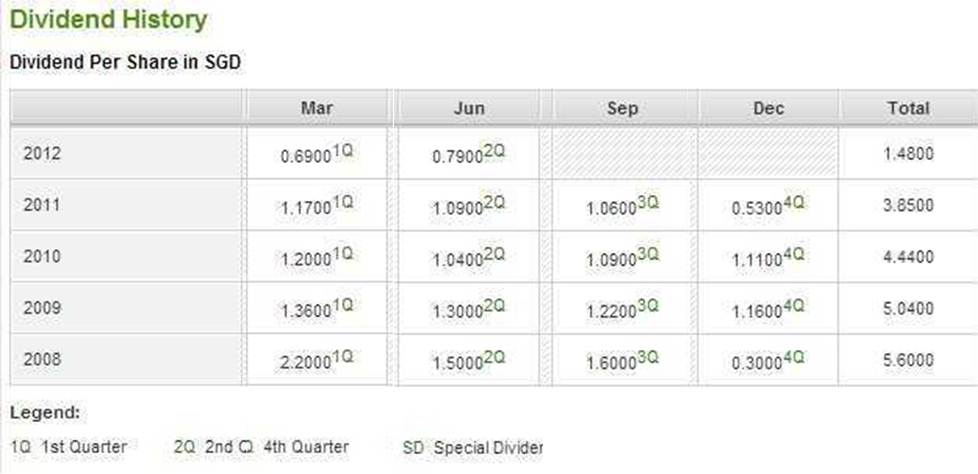

- From the chart below you can see that it has been giving out DPU of between 0.53 to 1.06 cents for the past 4 quarters. The Dec DPU dip is due to right issue issuance.

- If I average out the DPU, I will get 0.76 cents. Which means I will expect to get a yearly DPU of 3.07 cents. Based on today stock price of $0.455, the yield will be 6.7%. Pass criteria.

Price to NAV < 0.7

- Their NAV for the past 3 quarters are: $0.5977, $0.5662 and $0.5574. Will use the last NAV of $0.5574 vs current stock price of 0.455, the ratio is 0.816.

- Failed my criteria. So this indicate that there is not a lot of discount on the price. Ideally, I would like to have a 30% discount ($0.39) but now is giving me only 18% discount. That is the reason why this counter is on my watch list and not buying straight away.

- But having said that, almost all the REITs in Singapore have ran up in the past few months. Not suprisingly as there are not a lot of places you can park your investments that can beat 6% yield I checked the STI REIT average Price to NAV is 1.055. So you can say that this counter is still lagging the rest.

- Looking at the price trend for the past 2 years, it is very hard to catch it at $0.39. Currently it is on a very solid uptrend so I don’t think it will go down any time soon.

Debt to asset ratio

- Based on the recent report, total Asset stands at $1,586.1M and total Debt plus Liabilities is 23%.

- Passed my criteria of less than 35%.

Quality of its Properties

- I have not been to Indonesia so I can’t say much about the quality. But if I use the average occupancy rate as a proxy, it should give me a good indication of quality.

- Currently the occupancy rate is 94.7%. Compared to national average of 86.7% it is pretty good. But if you compared it to local REIT companies (normally very high at 98% or 99%), the number doesn’t look very good.

- I dug deeper and found out that the reason why is so “low” is because of one Mall, Pluit Village. Its occupancy rate is only at 75%. Not sure why it is so low. Compared to Q1, the occupancy rate actually went down from 77%! This could a thing to watch out for.

Financial strength of its main shareholders

- The Sponsor of LMIR Trust is PT Lippo Karawaci Tbk, Indonesia’s largest listed property company by assets, revenue and net profit.

- So not surprising the biggest shareholder for this REIT is Lippo Karawaci Tbk (“LPKR”) with about 650M shares. What is surprising is the next biggest holder is OCBC SECURITIES at 600M shares!

- One good point having Lippo Karawaci as the major shareholder is this REIT have first rights to refuse any new property release by the parent Lippo Group. So this definitely fit my criteria for strong shareholders.

Other significant factors

- Indonesia is booming now as their middle class play catch up with the other Asian neighbors. Their GDP per capita has been growing at 6.6% CAGR and is not slowing down amid the debt crisis. So the potential for upward growth in retail sector is definitely there.

- One thing that caught my eye while reading the report is they have changed the fixed base rent formula with Matahari (the biggest tenant-22% of total revenue) to a revenue sharing model. The way they structured it means they will have upside only gain!

Summary

I think this counter definitely have potential to generate good yield in the long run. I like the fact that there are still a lot of up sides. From optimizing the occupancy rate, to getting higher rental (due to new rent structure) and the opportunity to buy more properties. But I think the stock price have ran up a bit already, so I will wait for the next dip to consider again. This will be in my watch list.