Why investing is like a soccer game

“Goooooooooooooooal!”

I am just practicing shouting this when my favorite team (Brazil) wins the World Cup! I think it will be tough for them this year (2014) but I got to keep faith. They just got through to the semi-finals but their key striker (Neymar) is suffering a broken vertebra in his side’s win against Colombia. That is certainly a big blow to the team.

OK, back to the topic of investment. so how come investment is like a soccer game? let me count the ways:

1) You need strikers

You need strikers to score a goal like you need investment assets to grow your money fast. In a soccer match, typically you have defenders, mid fielders and strikers. each of them are trained to perform a very specific role. In the investment world, you should have different assets class to form your portfolio. Like bonds or banks savings to give you stable but low yield, big Blue chip or diversified ETF to give you higher yield and fast growing stocks to give you a chance to get very high returns.

In a soccer match, you cannot have only defenders or mid fielders to win a match. I mean look at the likes of Australia, Japan or England. What do they have in common? They didn’t win a single match in the group stage. So they are out faster than you can say “samba!”. Similarly for your investment, it means you cannot only rely on safe and low yielding assets to make you winner. You need to “strikers”.

2) You need to have a goal

This is quite common sense, but unfortunately not a lot of investors are not planning ahead. In the recent DBS survey they found out that many of them have retirement funds to last only 13 years out of the expected 20 years. That means they will run out of money 65% into their retirement. Also, it was found that only 49% of those surveyed have a financial plan in place! In others words, half of those interviewed are actually planning to fail.

Can you imagine a soccer team going into a tournament and not planning how to get to the top? It is like a team going in to World Cup without a coach or trainer. What do you think the chances of winning for that team?

3) you need to have strategies

Before a soccer match, team coach and managers will have to go through tons of analysis of the opponent’s strength and weakness. So as to think of a game strategy that have the highest chances of winning. That strategy comes in the form of different formation or opting for short or long passes.

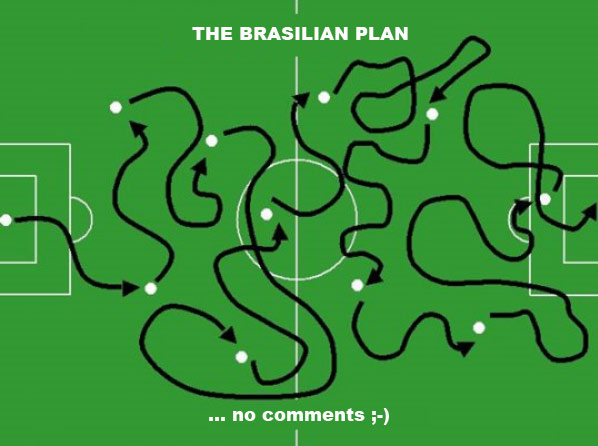

For fun, check out a cheeky look into the different plans…

In the investment world, your strategies will come in the form of portfolio allocation and how you grow those individual assets. Take for example, if you are in your 20s and 30s, you can afford to have more aggressive portfolio vs when you are in your 50s, you will need to re-balance your portfolio to have more conservative assets.

In a nutshell

Know what you need to do is only one part of the equation. You also need to know your own personality well so you can pick an investment strategy or method that suits you. Out in the market there are many ways to grow your money. You can do, forex trading, value investing, options trading or trend trading. The key thing is to find one that suits you and start investing.

Happy investing!

this article first appeared in Wealthdirections.asia.

Thanks for the article. But Brasil lost 0-7 to germany!. Anyway amazing logic you used there. Great discussion buddy.

Hi Jason, yes.. Brazil lost big time! sob sob. This little episode also taught me something about my investment style. That is don’t fall in love with any stock counter too much. If you attached too much emotion in it, all rational reasoning will be thrown out of the window. That my friend is the last thing you want to have when it comes to investing. So come 4 years later, I will definitely pick another… England? 😉