Fixed Rate vs SIBOR vs SOR. Which one to choose?

By Melvin Tan

When it comes to getting a housing loan, clients face a dilemma on what kind of loan structure should they go for. Firstly, clients must understand the nature of the various structures to determine whether it fits their risk profile and mortgage/property portfolio before jumping straight into the “lowest” rates in the market. They should be aware of the implications both in the near term and long term, in order to capitalise on the housing loan package overall as different loan structures work differently.

Basically for property financing, we are looking at 3 main options:

1) Fixed Rate

2) SIBOR rate

3) SOR rate

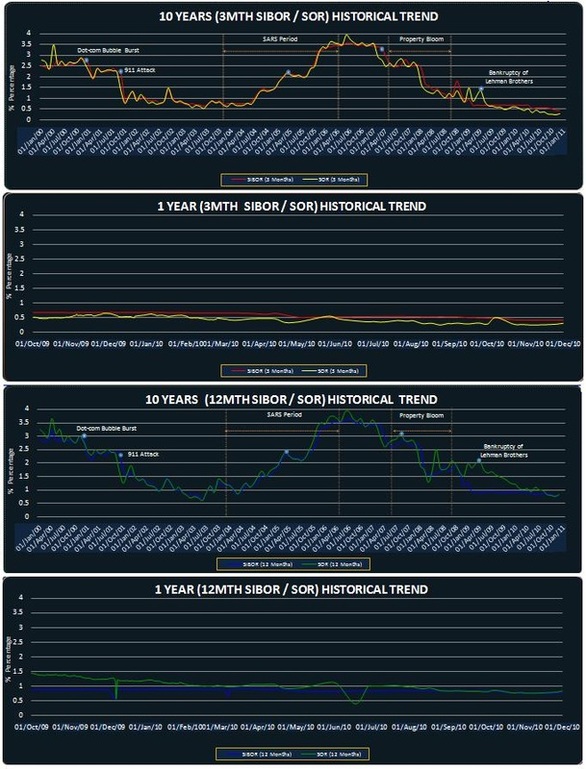

SOR has a volatile nature, being pegged against the US dollar movement through currency swaps. Even though it is at a very low level at 0.15% for the 3m SOR rate, its unpredictable nature is of higher risk level as compared to SIBOR. It is ideal if we are looking at a 1 year outlook, or perhaps 1.5 years to be on the safe side, to really capitalised on its low level. However, for SIBOR, we can look at the 1m SIBOR rate, which is at 0.31% currently. Though higher, it is much more stable and when the US Fed starts to hike up their interest rate, SIBOR typically would rise at a slower pace as compared to the SOR rate, due to the strengthening of the US dollar when interest rate moves up.

A safer approach would be either a fixed rate or a SIBOR package. In my opinion, a SIBOR package would be favourable over a 2-3 year outlook, especially with the US Fed being more cautious in revising their rates upward, due to their main priority to keep rates low to stimulate their economy after the severe financial crisis. When we do a direct comparison with the lowest 3 year fixed rate package (DBS) at 1.61% 3yr average rate, against HSBC SIBOR package (1st yr: 1m SIBOR + 0.65%, 2nd yr: 1m SIBOR + 0.70% 3rd yr: 1m SIBOR + 0.70%):

1) 1m SIBOR + 0.65% = 0.96% currently. Thus, as long the 1m SIBOR do not move up to 0.9% within the 2-3 years’ time frame, the SIBOR package would outweigh the fixed rate package overall.

2) Another key advantage is the low bank spread for the SIBOR package from year 4 onwards when we compared against the fixed rate package, which charges SIBOR + 1.25%.

3) For client going for a fixed rate package, the rates are not attractive once the fixed rates end and auto converts to a floating rate. Thus, when client go for a fixed rate package, they would need to do a refinance/repricing over and over again, with costs involved.

4) A bank spread of 1.00% from the 4th year onwards is consider attractive, and we might not be getting such a margin 3-4 years later. Thus, we are looking at opportunity costs.

Of course, going for a SIBOR package, the client must be comfortable with the risk involved. If client is of conservative nature, it is more suitable to look at fixed rate. However, I would advise on the 5 year fixed rate package if client is really keen to go for fixed rates, as the Maybank 5 year average rate of 2.02% is still consider low, especially if we are able to lock in the rates for the next 5 years, instead of 3 years. 2.026% vs 1.61%: Compromise on a slightly higher rate, but with a certainty over an additional 2 years, especially when the market is definitely more unpredictable when we look beyond the 3 year outlook.