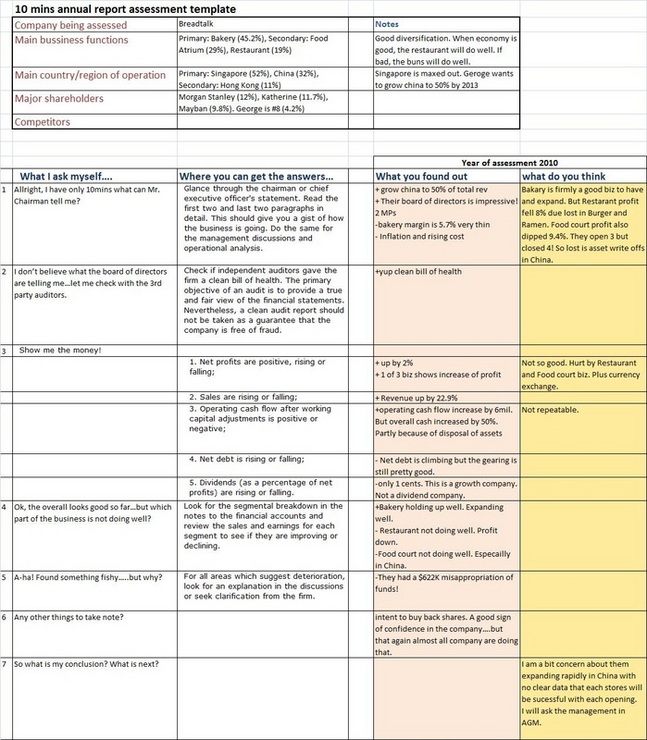

Breadtalk 2011 annual report

It is reporting time again. I was quite busy reviewing the many different company’s annual report.

First one I want to post is Breadtalk. I am sure most of the readers know or heard about this company and their wonderful Pork Floss buns… but do you know that they are also involved in Food Court and Restaurant business? Apparently they did quite well in 2010 with 22.9% jump in revenue! On one look it is impressive… but what else did I learn?

But before I go into the details, I just want to inform that I am leveraging SGX’s “An investor’s Guide to reading Annual Report” format of assessing a company only looking for key areas. Here is what I found:

Key highlights:

1) Revenue:

-Bakery: revenue up by 22.1%, Operating profit up by only 15%, plus almost 50% of profit is due to property disposal!

-Restaurant: revenue up by 44.4%, Operating profit fell by 8.8%. Losses came from Bangkok, Burgers and Ramen.

-Food Court: Revenue up by 13.2%, operating profit fell by 9.4%. Losses came from write off at China food courts.

-As a Group Profit attributable to share holders fell by 4%.

2) Debt

-Gearing is very respectable at 0.26.

3) Others

-Most shocking is they have $622K of funds being misappropriated in China!

-All in all, from the number it doesn’t look too good. The expansion plan is solid, but I am concern about their ability to execute. Hopefully I can get more insights to their plans in the AGM.

Anyone going?

More details of my assessment below: